VA Home Loan Assistance for Veterans: Your Step-by-Step Guide to Buying a Home

For many veterans, homeownership represents more than a financial investment; it’s a symbol of stability, freedom, and the next chapter in life after service. But navigating the housing market and the mortgage process can feel overwhelming. That’s where the VA home loan program for veterans comes in.

At National Veterans Homeless Support (NVHS), we’re committed to helping veterans avoid homelessness and build lives of long-term stability, including pathways to permanent housing. The VA home loan is one of the most powerful tools available to veterans. This benefit makes buying a home more accessible by removing many traditional financial barriers.

In this guide, we’ll walk you through everything you need to know to apply for a VA loan, from eligibility to closing, and show you how this program can help you or a veteran you love to achieve the dream of homeownership.

Have questions? Reach out today!

How to Apply for a VA Loan Understanding a VA Home Loan

Understanding a VA Home Loan

A VA home loan is a mortgage loan backed by the U.S. Department of Veterans Affairs (VA). It was created in 1944 to support returning service members as they reintegrated into civilian life. The program allows veterans, active-duty service members, and certain surviving spouses to purchase homes without a down payment or private mortgage insurance (PMI).

Unlike traditional loans, VA loans are provided by private lenders—such as banks, credit unions, or mortgage companies—but guaranteed by the VA. That means lenders take on less risk; in return, veterans can access more favorable loan terms

Who’s Eligible for a VA Loan?

To qualify for a VA loan, you must meet one of the following service conditions:

- Veterans with at least 90 consecutive days of active service during wartime or 181 days during peacetime

- Active-duty service members currently serving.

- National Guard and Reserve members with six years of service

- Surviving spouses of veterans who died in the line of duty or from a service-connected disability

If you’re unsure whether you qualify, we can help connect you to the right VA resources or guide you in requesting your Certificate of Eligibility (COE).

VA Loans vs. Conventional Loans: Why Veterans Win with VA Benefits

VA loans offer several significant benefits that make them an ideal option for veterans:

- No Down Payment Required: Conventional loans require at least 3–20% down. VA loans allow you to purchase a home with zero down, making homeownership more accessible.

- No Private Mortgage Insurance (PMI): PMI is typically required for conventional loans with less than 20% down, adding hundreds of dollars to monthly payments. VA loans eliminate this cost.

- Lower Interest Rates: VA-backed loans often come with more competitive interest rates, saving veterans thousands of dollars over the life of the loan.

- Flexible Credit Requirements: While a good credit score helps, VA loans are more forgiving of lower credit scores than traditional mortgage options.

- Limits on Closing Costs: The VA restricts the kinds of closing costs veterans can be charged, making the final expense more manageable.

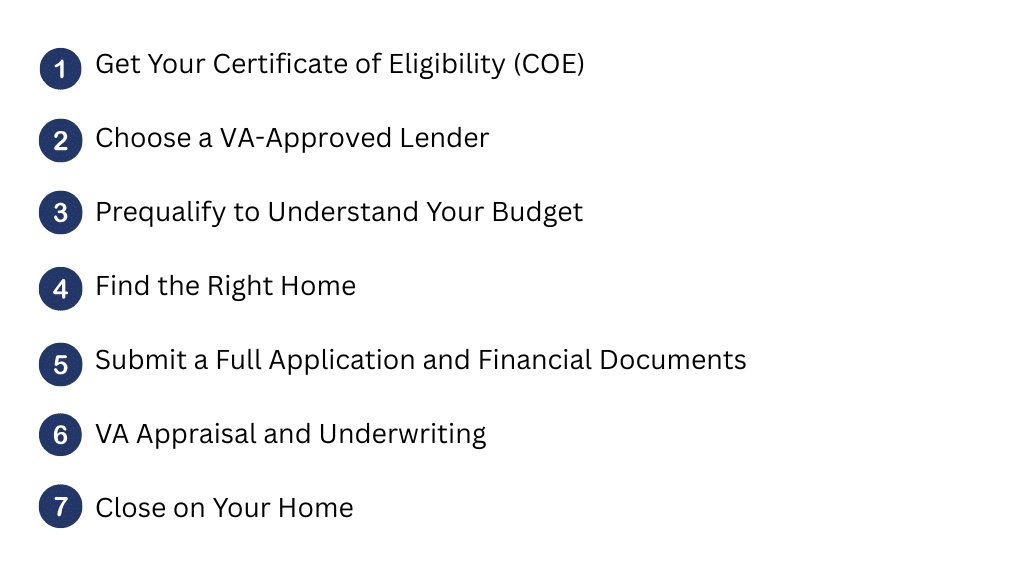

Step-by-Step: How to Apply for a VA Loan

If you’re ready to pursue homeownership using your VA benefits, here’s a breakdown of the full process from start to finish:

Get Your Certificate of Eligibility (COE)

The COE verifies to lenders that you’re eligible for a VA-backed loan. You can obtain one in several ways:

- Online via the VA’s eBenefits portal

- Through your lender, if they offer VA loans

- By mail, using VA Form 26-1880

This document is the key to unlocking your VA loan benefits and should be secured early.

Choose a VA-Approved Lender

Not every lender is qualified or experienced in handling VA loans. It’s essential to work with a VA-approved lender who understands the ins and outs of the process and can help you avoid unnecessary delays or costs.

Prequalify to Understand Your Budget

Before you start house hunting, prequalify for your loan by providing your lender with financial information such as:

- Income and employment details

- Credit score

- Existing debt obligations

This step helps you understand what kind of home you can afford and gives you confidence in the search process.

Find the Right Home

Once you know your budget, it’s time to start house hunting. Whether you’re looking for a family home, a quiet place to retire, or a starter property, ensure the home meets VA appraisal standards.

Veterans can purchase:

- Single-family homes

- Townhomes or condos (if VA-approved)

- New Construction

- Manufactured homes (with restrictions)

Submit a Full Application and Financial Documents

Once you’ve found your home and made an offer, you’ll complete a formal mortgage application with your lender. Be prepared to provide:

- Recent pay stubs or income statements

- Bank statements

- Tax returns (usually the last two years)

- Proof of military service (if not already submitted)

VA Appraisal and Underwriting

After submitting your application, two key steps will take place:

- VA Appraisal: The VA will appraise the property to ensure it meets safety standards and is worth the purchase price.

- Underwriting: The lender will review your entire application to confirm eligibility, financial strength, and readiness for approval.

Close on Your Home

If the appraisal and underwriting go smoothly, you’ll receive final loan approval and move to closing. This is when:

- You sign the final paperwork.

- Pay any allowable closing costs.

- Get the keys to your new home.

VA Loans and Housing Stability: A Path Away from Homelessness

At NVHS, we believe homeownership is one of the strongest ways to prevent veteran homelessness. When veterans are given the tools and support to purchase a home, they gain more than a roof—they gain roots.

VA loans offer a powerful opportunity for veterans to transition from unstable or temporary housing into long-term, generational stability. If you’ve struggled with rent increases, eviction threats, or homelessness in the past, buying a home with a VA loan could be your fresh start.

Ready to Take the First Step? NVHS Can Help

The VA loan process doesn’t have to be overwhelming. Whether you need help securing your COE, finding a lender, or understanding how a mortgage fits your financial picture, NVHS is here to support you

We can also connect you with other essential services, including:

- Financial counseling

- Emergency housing support

- Referrals to veteran-friendly lenders and agents

- Case management and VA benefit navigation

Support Our Mission to End Veteran Homelessness

When you support NVHS, you’re doing more than providing temporary aid. You’re helping veterans move from crisis to stability—from homelessness to homeownership.

Here’s how you can help:

- Donate to fund outreach, housing support, and VA loan education

- Volunteer your time or professional skills

- Share this resource with a veteran who could benefit (Facebook, LinkedIn, and YouTube).

A Home of Your Own Can Start Here

A VA loan isn’t just a financial product—it’s a powerful symbol of your service and sacrifice. If you’re ready to stop renting and start building equity, security, and peace of mind, this is your moment.

Need Help Getting Started? NVHS Can Guide You.

A Sheriff’s Perspective: What It Means to Serve Veterans Truly

A Sheriff's Perspective: What It Means to Serve Veterans Truly When we talk about serving veterans in Central Florida and beyond, we often think of ceremonies, salutes, or plaques on the wall. But for many of our nation's heroes, especially those facing homelessness, mental health challenges, or isolation, true service [...]

Giant Recreation World Supports NVHS

A big hug 🥰 and thanks to Giant Recreation World for their ongoing support and $28,630 donation! Special thanks to GRW's VIP Camping Club whose help has enabled ongoing support to NVHS year after year, with a total of $136,000 contributed since 2015!!! @https://m.facebook.com/GiantRecreationWorld/

Passionate volunteers continue to help local veterans

Check out the latest NVHS volunteer spotlight in Senior Life Newspaper! R. Norman Moody, May 1, 2021 We know that Brevard County has a large veterans population. And there are many residents who support and are willing to help wherever there is a need among the men and women who [...]